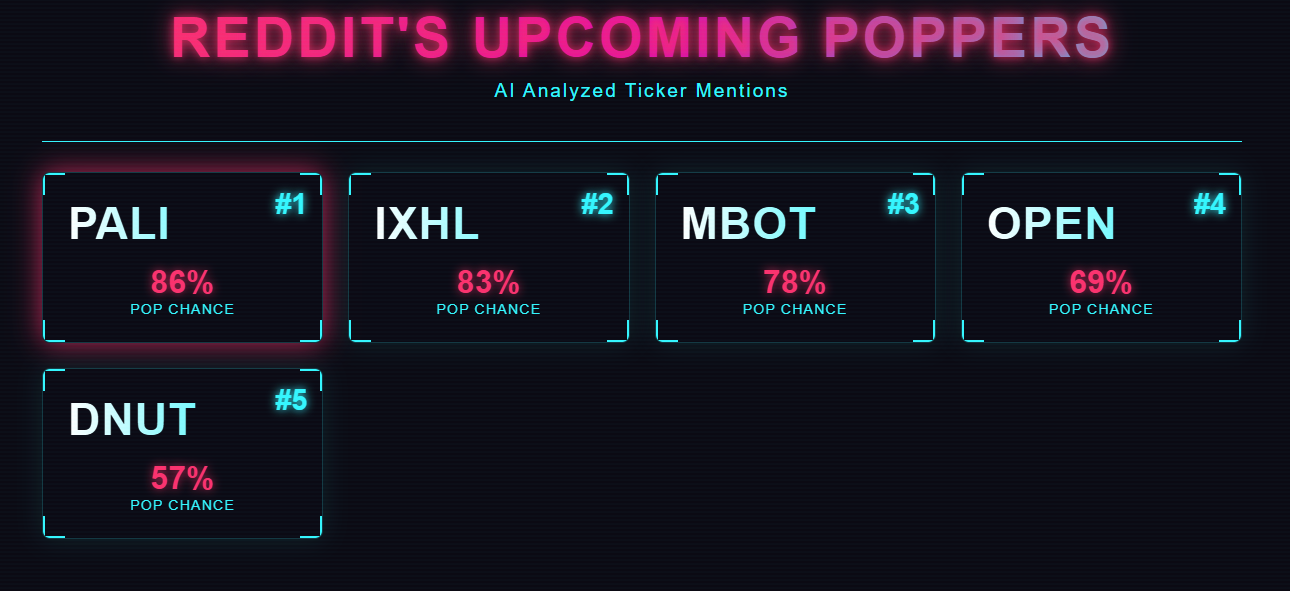

Top Poppers

Here are the current poppers chosen by the AI that analyzes all the tickers mentioned on Reddit in the last week and displays the top 5 highest pop percentage stocks. These tickers can even range from NVDA to DNUT to OPEN. The pop percentages are determined by the company profile, its historical price, its technical data, its financial status and lastly, past and upcoming news / catalysts.

For each trading day, I will make a post about the list and information on each stock in the top 5.

Here are the details for each stock:

$PALI

Palisade Bio Inc.'s main product is the PALI-2108 which is a new oral medication designed to treat swelling, irritation, and soreness in the intestins, while specifically targeting ulcerative colitis and fibrostenotic Crohn’s disease. Currently, $PALI is still in Phase 1b of their clinical trial, meaning they have completed Phase 1a with super positive results, showing strong safety and effectiveness. As of April 9, 2025 they commenced dosing for patients in the Phase 1b. While Phase 1b is underway, Palisade is actively preparing, for PALI-2108's Phase 2. This clinical trial is advancing at a very fast pace. The study completion for Phase 1b could happen anytime now. In other words, this means that we could see news very soon.

$KSS

Kohl’s Corp. is a well-established retail giant known for its wide range of apparel, footwear, and home products. Recently, Kohl’s has been focusing on revitalizing its business through expanding partnerships, enhancing its online presence, and improving customer loyalty programs. Financially, Kohl’s has shown steady improvements with better-than-expected earnings and efforts to reduce debt. They’ve also been exploring innovative ways to drive store traffic, including new product lines and collaborations. Despite challenges from the broader retail environment and competition from both online and brick-and-mortar stores, Kohl’s remains a key player with a solid footprint across the U.S. The company’s upcoming quarterly results and holiday season performance will be crucial in determining if the turnaround strategy is working effectively.

That said, it’s still a clinical-stage biotech, so most of the value hinges on how trials go and whether they get regulatory approvals. There’s definitely potential, but it's still a speculative play for now.

$MBOT

Microbot Medical Inc is a post clinical stage medical device company featuring their LIBERTY® Endovascular Robotic System. Their robotic system has already passed all clinical trials with 100% success rate and reduced radiation by 92% which is groundbreaking in the healthcare industry. Their product already has 9 global patents including 1 in China, where the endovascular demand is surging. Liberty's founding team consists of professionals in robotics and in medical devices. The next step is FDA approval to sell in the U.S. Once this happens, they will be able to start producing these machines and selling them to hospitals.

$OPEN

Opendoor Technologies Inc. has been grabbing headlines as it pushes to shake up the traditional real estate market. The company’s business model—buying homes directly from sellers, renovating them, and then reselling—has had its ups and downs, but it’s trying to find out a new way for people to buy and sell homes faster. The stock has seen a rollercoaster ride, partly because of market volatility and changing home prices, but Opendoor keeps innovating. They’re expanding their footprint in more cities and improving their tech platform to make the process smoother and less stressful for customers. Despite some challenges like tight housing inventory and fluctuating interest rates, Opendoor’s focus on streamlining real estate transactions and providing instant offers has helped it stay relevant. They’re also investing in data and AI tools to better price homes and speed up sales. With a big market still to capture and the housing market constantly evolving, Opendoor’s growth story is still very much a work in progress. The next few quarters will be key to see if they can turn their concept into consistent profits.

$DNUT

Krispy Kreme Inc. has been getting a bit of attention lately after its stock price jumped. Part of the hype comes from it being added to some small-cap indexes and some meme stock traders jumping in. The company had a rough patch earlier this year, dealing with a cybersecurity issue and putting the brakes on its McDonald’s expansion pilot. But they’ve bounced back since. They’ve been running some clever promotions too, like their 88-cent dozen deal for their 88th birthday and a new collaboration with Warner Bros. called “Hungry for Heroes.” These moves keep the brand fresh, even though it’s not in the hot tech or biotech space. What’s really interesting is that Krispy Kreme keeps growing steadily worldwide. Their partnerships with big retailers like Costco and Tesco are helping with that. Even if the recent stock rise seems more about hype than strong financials, the company has managed 18 straight quarters of same-store sales growth, which is impressive. With a refreshed leadership team and another earnings report coming up, $DNUT might keep its momentum going—especially if it stays connected with its customers and relevant in pop culture.