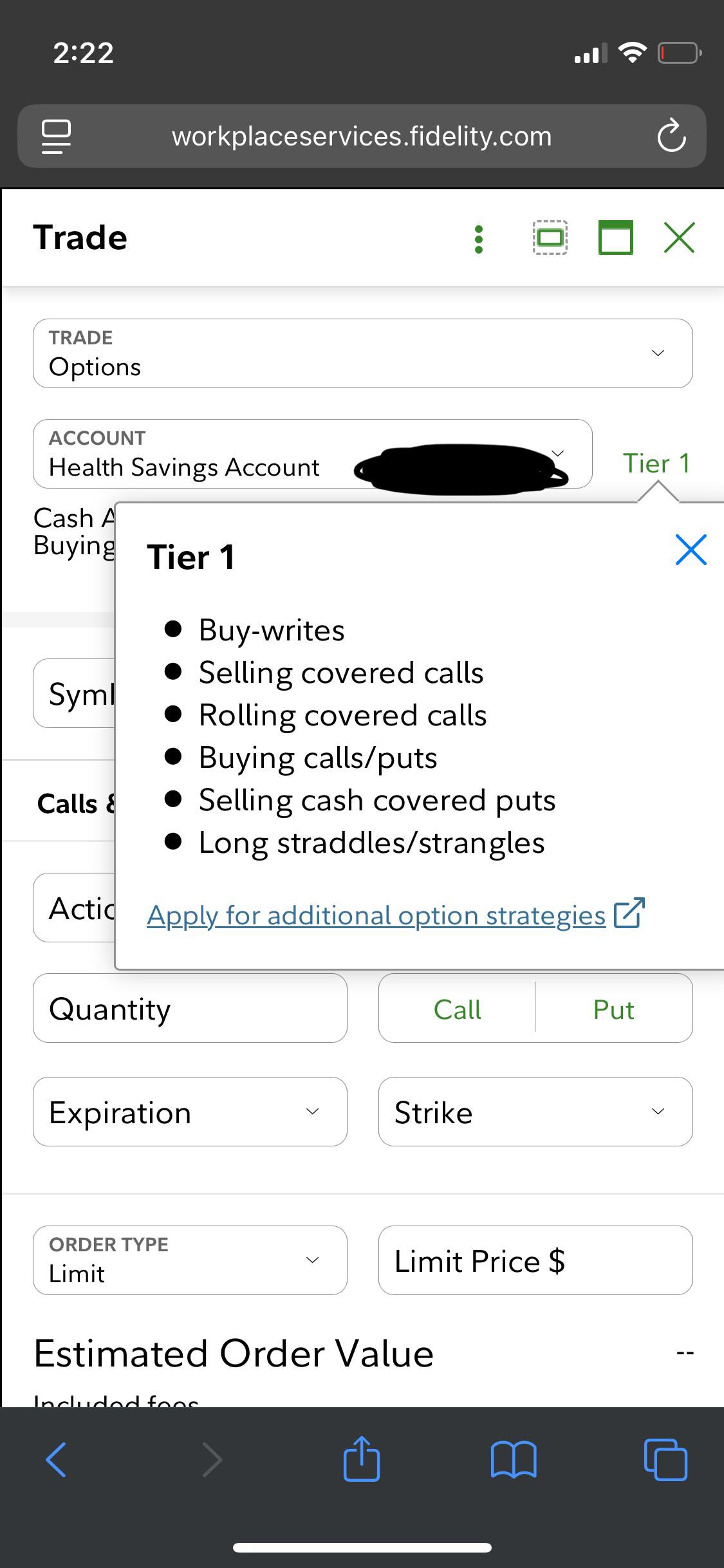

The most absurd loophole I've seen yet

Holy crap. I just noticed my HSA allows options strategies. It even has crypto and letfs💀. Im definitely gonna try to get spread access because this might be the only free lunch in life...broken.

In case you dont know what a HSA is, heres a quick rundown from AI:

Triple Tax Advantage

1. Tax-Deductible Contributions

– Lowers your taxable income immediately.

– Up to $8,300/year for families (2024), indexed to rise.

2. Tax-Free Growth

– Any gains (dividends, interest, capital gains) grow without being taxed.

– Can invest in stocks, ETFs, or even options (depending on provider).

3. Tax-Free Withdrawals

– Withdrawals are 100% tax-free when used for qualified medical expenses — which you’ll inevitably have in life.

Strategic Financial Utility

4. Defer Reimbursements Indefinitely

– You can pay out-of-pocket now, let the HSA compound untouched, and reimburse yourself tax-free years or decades later (just save receipts).

5. No Use-It-or-Lose-It

– Unlike FSAs, your HSA balance rolls over forever — it’s your account, not your employer’s.

6. Ultimate Retirement Flexibility

– After age 65, withdrawals for non-medical expenses become penalty-free (though taxed as income, like a traditional IRA).

– Can also still use tax-free for medical.

Health Plan & Cost Savings

7. Lower Premiums with HDHP

– High-deductible plans typically have lower monthly premiums, saving you cash flow while young and healthy.

8. Control Over Healthcare Spending

– You decide how to spend, save, or invest. Can shop smarter for care since you’re incentivized to be cost-aware.

9. Emergency Medical Fund

– Tax-free access to pay for surprise expenses (ER, prescriptions, dental, etc.) — you don’t have to sell investments or go into debt.

📈 Tier 4: Long-Term Wealth Engine

10. Can Grow to 7+ Figures

– With max contributions and 15–20% CAGR, an HSA can reach $1M+ in 30–40 years, all tax-free if used for healthcare.

11. Compound Monster with Employer Contributions

– If your employer adds ~$1,000/year, that’s free money compounding tax-free.

12. Low-Maintenance Leverage

– Can use LETFs or stock indexes to grow passively with little effort or micromanagement.