is this SPY strategy too good to be true? 0DTE

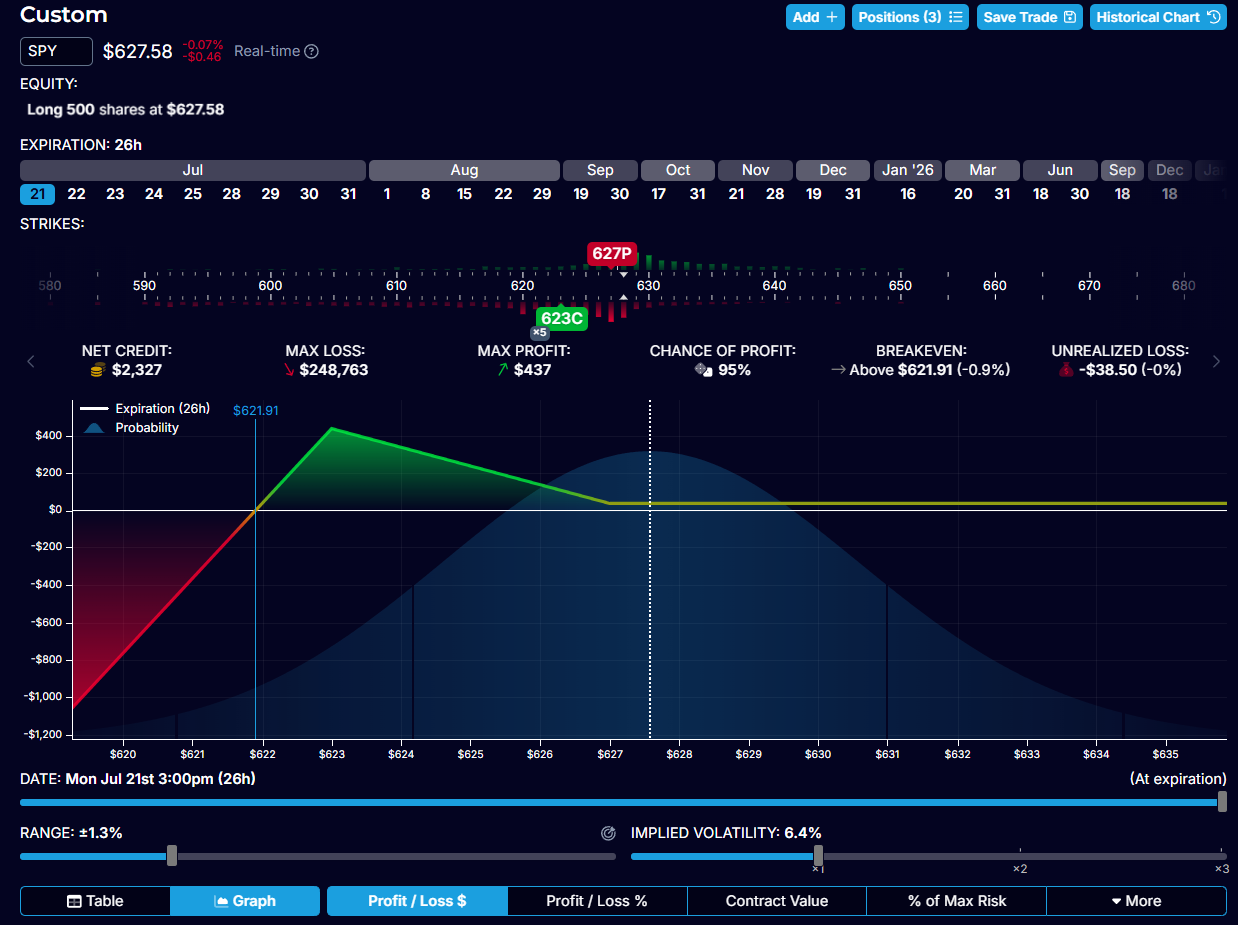

Buy 500 shares of SPY at $627.58, 0 DTE, buy 1x 627P, sell 5x 623C. Do all of these at the exact same time.

**Watch SPY carefully and automate if needed.**

1) If SPY goes up, we hold, securing a $37 profit at the end of the day.

2) If it goes down \~0.5%, close out all positions for a $250 profit. If we can't catch it fast enough and it goes down .6%+ or more, very fast, then we lose money and stop loss, exiting all the entire trade.

Seems too good to be true? Maybe it's because it's the weekend and these numbers aren't calculated right?

The only way to lose is if you're not paying attention and SPY has a sudden flash crash type drop. You could automate a Take Profit/Stop Loss with an advanced options order, so there's really no reason you would be late to the party.

What am I missing?